Breadcrumb

Student Eligibility

Student Awards: Criteria, Student Eligibility, and Election of Recipients

For many students, finding ways to fund college other than out of pocket is essential. There are different types of financial aid, or funding for college including scholarships, work-study jobs, grants, and loans.

- Scholarships are “free money” offered to help students pay for college. Scholarships can be based

on academics, athletics, or the criterion specified by the scholarship donor. Students

should apply for as many scholarships as they are eligible for. In addition, scholarships

do not have to be repaid.

- At Louisburg College, we offer many scholarships such as Merit Scholarships, Endowed Scholarships, and some Athletic scholarships.

- The Lettie Pate Whitehead Scholars program annually provides scholarship support to deserving female Christian students in the South with financial need and an interest in the health professions. Lettie Pate Whitehead scholarships are included in the recipients’ total financial aid package, and the scholarship follows scholars through their course of study. Lettie Pate Whitehead had a keen sense of duty to those in need, as well as a gracious and generous spirit. Lettie Pate Whitehead Scholars honor these attributes and responsibilities by participating annually in annual academic lectures, service projects, and professional development programs.

- Federal Work-Study provides part-time jobs for students in financial need to help pay for expenses.

- Grants are also considered “free money” that do not have to be repaid as long as eligibility

requirements are met. Most grants are federal money and are awarded based on financial

need. Students must complete the FAFSA to become eligible for federal and state grants.

- Students who are acknowledged as North Carolina residents may be eligible for the North Carolina Need-Based Scholarship. The North Carolina Need-Based Scholarship for Private College Students aids many Louisburg College students in funding of their college journey. The award amount varies and carries a rolling deadline. Requirements to receive this award include:

- Be a North Carolina resident as well as a North Carolina resident student for tuition purposes, as defined by the North Carolina Residency Manual

- Be enrolled as an undergraduate student in at least 9 credit hours at a qualifying private North Carolina campus

- Meet requirements for the Federal Pell Grant (except the Expected Family Contribution (EFC) range used for Federal Pell Grant awards)

- In order to receive the full award amount allotted as a North Carolina Need-Based Scholarship recipient, students must be enrolled in 12 credit hours per semester classified as a “Full Time Plus” student.

- Loans are a form of aid that must be repaid. This is money you borrow and pay back with interest. Loans are offered by the federal government and private organizations.

Federal vs. Private Student Loans

Federal student loans are provided by the government and often include fixed interest rates that are generally lower than private loans. Federal loans offer more flexible repayment options. Private loans are provided by banks or state-affiliated agencies and often require a co-signer. Private student loans should be the last resort option to cover college costs.

Subsidized and Unsubsidized Loans

Subsidized and unsubsidized loans are the primary loans offered by the federal government. Subsidized loans are only offered to undergraduate students in financial need. Need is determined by the federal government with the FAFSA application. Unsubsidized loans are available to all students and are not based on financial need.

Direct PLUS Loans

Direct PLUS loans are offered to parents of undergraduate students and can be useful if subsidized and unsubsidized loans or other forms of financial aid do not cover all cost of attendance. These should be a last resort next to private student loans.

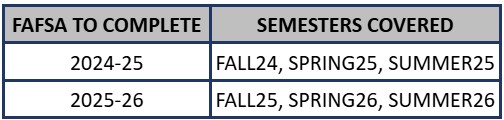

Completing a FAFSA

Students wishing to receive federal financial aid such as grants, loans, or work-study must complete the Free Application for Federal Student Aid (FAFSA). FAFSA information is also used to determine eligibility for certain state and school financial aid. Completing the FAFSA does not obligate you to accept any financial aid offered, you will be able to review and decide what aid you need and want to accept. Please make sure to list our school code: 002943.

FAFSA Completion Priority Dates

- Fall - July 1

- Spring - December 1

- Summer - May 1

Method and Frequency of Title IV Disbursements, Loan Terms, and Loan Information

All federal student aid will be disbursed to continuing (students previously enrolled at Louisburg College) students' accounts sometime after the first day of classes. New student's federal student aid will be disbursed 30 calendar days after the first day of classes. The financial aid office will disburse the student's aid via the Common Origination and Disbursement System (COD) and will be reflected on the student's account.

Federal Direct Loans can be subsidized, unsubsidized or the optional Parent PLUS for parents of dependent students. All Federal Direct Loans charge an origination fee. View more information on fees and interest rates.

Although you may be assigned a repayment plan when you first begin repaying your student loan, you can change your repayment plans at any time- for free. View more information on repayment plans.